Knowing your credit score is very useful if you are trying to plan for your financial future. Credit Karma is one of the best and most well-known credit reporting websites/apps.

It offers users free access to their credit score and credit report, as well as helping people compare financial products that they may qualify for, such as loans or credit cards aimed at their credit level.

Credit Karma is a great starting point for monitoring the health of your finances, but it has some limitations in terms of the credit reference agencies that it works with, and the features that it offers.

If you’re looking for an alternative to Credit Karma, consider some of the following options. In the list below we have researched and curated some great alternative sites and apps similar to Credit Karma for credit reporting (and much more).

(The ranking below is in no particular order).

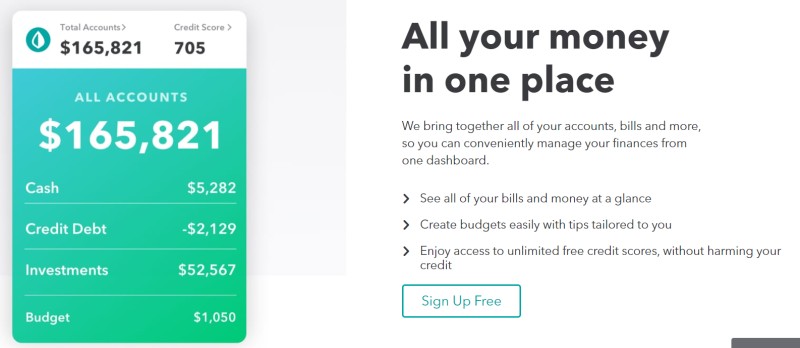

1) Mint

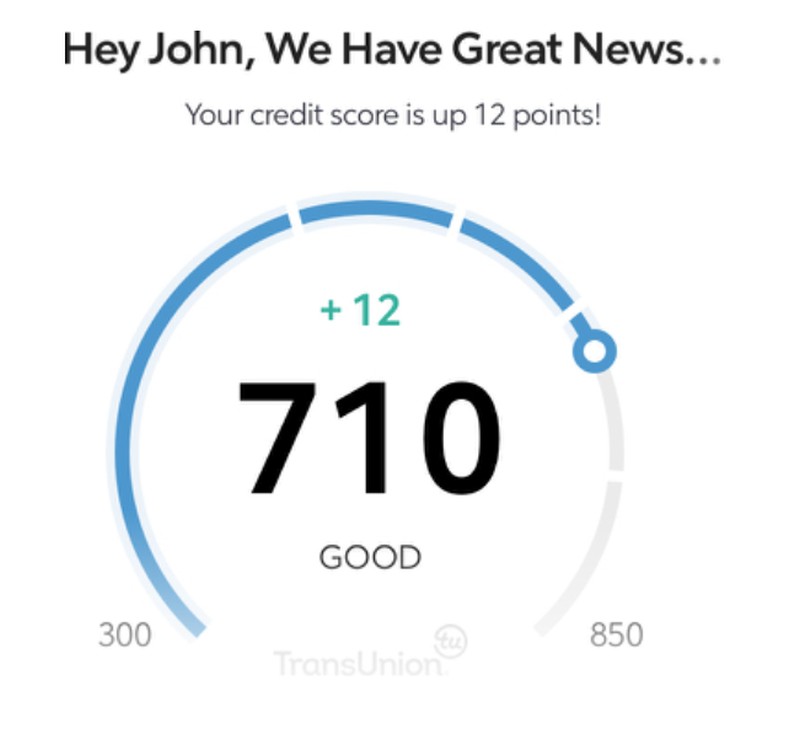

Mint is an app that offers budgeting, bill payment and investment tracking all in one handy app. It also offers credit scores, free of charge, with credit alerts whenever TransUnion receives information that might impact your credit score.

This means that it helps you not just keep track of your current score for borrowing purposes, it also serves as an early warning sign for identity theft.

If you are informed your score has changed because someone opened an account and that person wasn’t you, then you will be able to take action quickly – hopefully before your credit score is significantly damaged.

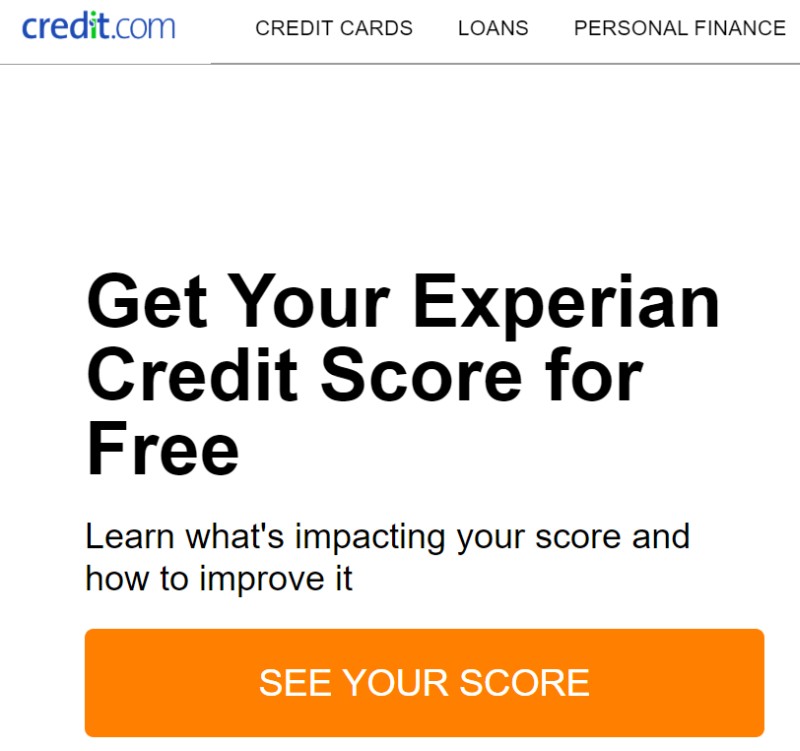

2) Credit

Credit.com is an app and browser-based credit score tool that reports your Experian credit score. The app is free of charge, with no credit card required to open an account.

There is an Android and Google Play version of the app, and you can access the information via your web browser as well if you prefer.

In addition to telling you your score, Credit will also explain how scores are calculated and give users advice on how to improve their scores.

The tool is useful for credit education and repair, and since you can set up alerts it helps in the fight against identity theft as well.

3) Credit Sesame

Credit Sesame bills itself as a personal credit management service that helps people improve their credit rating and their overall finances.

It uses TransUnion to provide a clear and easy to understand overview of the factors that affect a person’s credit rating.

It also offers a service that helps people choose cards or loans that are appropriate for their finances. This can be useful for people with a good credit rating, helping them to identify the best deals on the market.

It is also helpful for those in the process of building their credit rating since it will help them to select the financial products that offer the best prices and the best chances of being accepted with their current score.

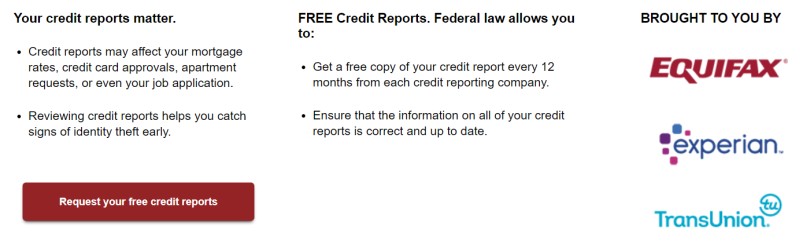

4) Annual Credit Report

While most of the products and services in this list offer unlimited reports from one specific agency, Annual Credit Report works slightly differently.

This service offers users a free report from the three main credit reference agencies: Experian, TransUnion and Equifax, once per year.

This is helpful for people who will be exploring the market for a significant purchase such as a mortgage, since it helps prospective borrowers make sure that their financial details are accurate across all the major credit reporting groups.

5) Equifax

If you just want a bare-bones report, and don’t want to give your personal data to a middleman in order to get them, then you have the option of going directly to the credit reference agencies themselves.

Equifax allows users to request six free credit reports per year. This is a bare-bones service. There are no loan or credit card matching tools, and no alerts.

The benefit, however, is that you are going direct to the source. This means less risk of spam or marketing calls from the creators of the apps, and the people who are trying to sell loans.

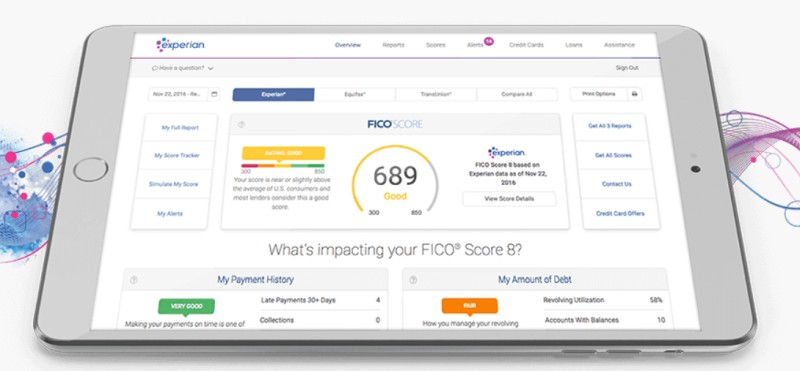

6) Experian

Experian CreditWorks Premium is a aid-for tool that checks Experian, TransUnion and Equifax credit reports daily, and then informs users if they have changed.

The credit score is based on FICO Score 8 for most of the calculations, but for some types of credit other scores may be used.

This tool is a good option for people who want to maximize their credit score, those who are planning a house purchase soon, and those who are worried about identity theft. There is a monthly fee, but the first month has a low introductory price, allowing users to try the service for minimal risk.

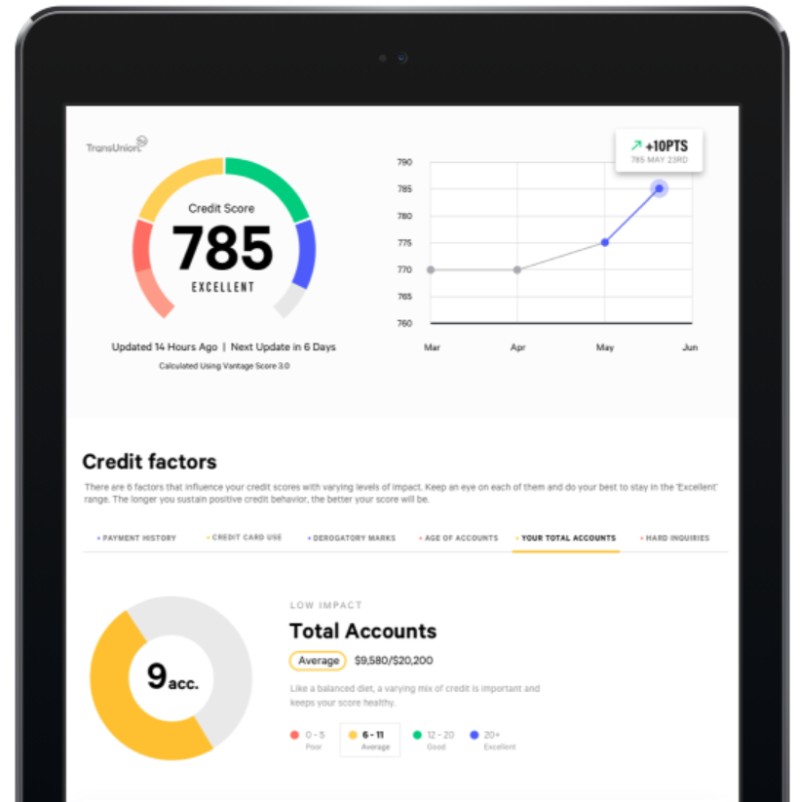

7) TransUnion

TransUnion allows users to request one credit report per year, free of charge. Everyone who does not use a credit reporting tool should consider taking advantage of this.

If you want more than one report per year from TransUnion, then you can sign up to their year-round service, which allows you to access your credit report as often as you wish.

This service also informs you if there are new accounts opened in your name, changes to your credit card balance, or any negative reports made by creditors.

8) CreditWise

CreditWise is a free credit monitoring app that is produced by Capital One. While the app is made by a lender, it doesn’t impact your credit score to set up an account with it.

The service has some rather handy tools, such as a simulator which allows you to see what is likely to happen if you make certain changes to your financial habits, such as paying off a loan or increasing the limit on one of your credit cards.

This is a useful form of financial education which can help you as you prepare yourself to make major loan applications in the coming months or years.

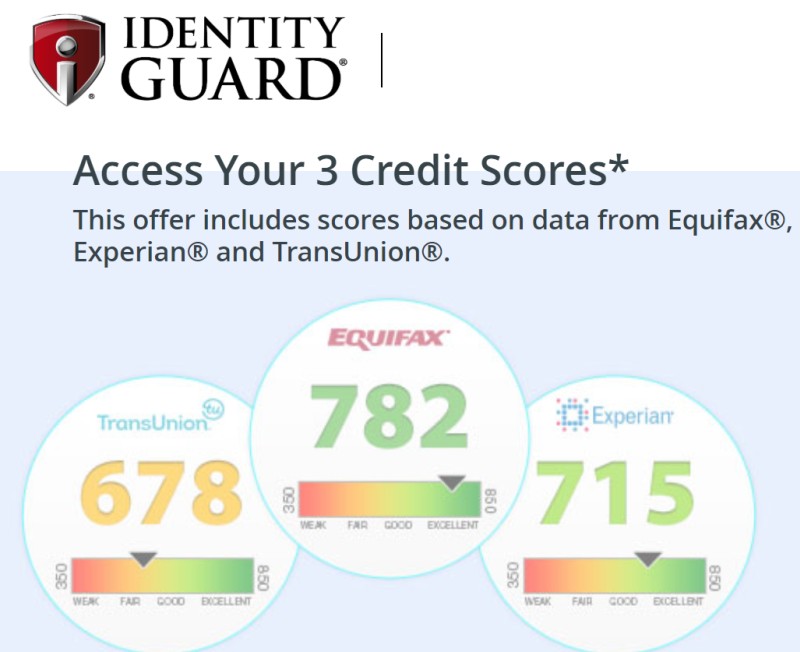

9) Identity Guard

IdentityGuard is a tool that helps to protect users from identity theft. It is easy to set up an account, and once you are up and running you can get alerts about major changes to your credit record, giving you an early warning in the event of potential fraud.

One particularly nice thing about the service is that it has tiered pricing, with the option of signing up for a family account and protecting not just your own financial information, but that of your spouse and children as well.

Credit accounts opened with a child’s SSN are a common scam these days, and something that many young adults only find out about when they start their own financial life.

10) Bankrate – Quizzle

Bankrate – Quizzle is a credit report tool that was created when Quizzle was acquired by the Bankrate team.

This credit improvement tool offers credit reports, charts, and a breakdown of the factors that are impacting on your credit score.

Signing up for an account is free, and the tool offers access to your full credit report with weekly updates on your score, alerts when your credit report changes, and tracking tools to help you understand how your credit score is changing over time. The tool also offers personalized rates for financial products.

11) WalletHub

WalletHub offers free credit scoring updated on a daily basis, along with free credit reports and an analysis of the factors that go into creating your credit score.

The tool is accessible via a website, and also a mobile app. Signing up is quick and easy, and the service will help you to find credit cards, rewards cards, loans and mortgages that might be suitable for you based on your current credit score.

Most free credit score tools offer only weekly or monthly updates, so having access to a daily update makes this an appealing choice.

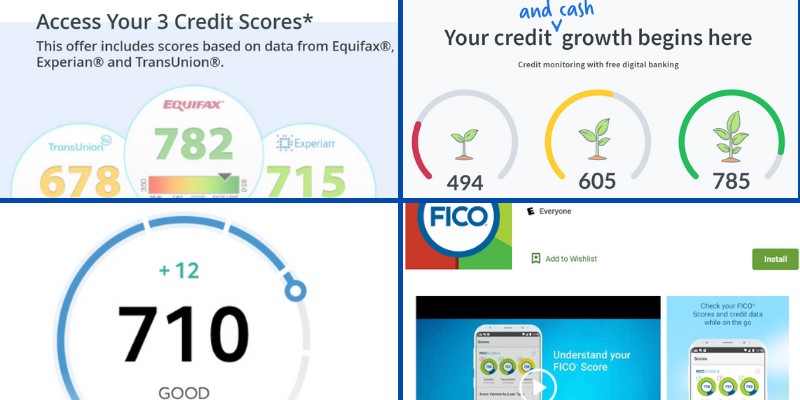

12) Discover Card FICO Score

This tool from Discover provides users with a FICO score based on information from TransUnion. FICO scores are the most commonly used scores by the major lenders.

The score is based on the amount of money owed, the length of the person’s credit history, how much new credit has recently been opened, and the type of that credit.

Discover provides users with a score that is updated on a regular basis, with the date that the score was updated being indicated on the dashboard.

The score is a snapshot, and may not be updated as often as some other tools, but it is free to access, and a good option for people looking to learn what information TransUnion has on their records.

13) Chase Credit Journey

Chase Credit Journey is a free credit score reporting app that is open to anyone who wants to check their score, even if they are not a Chase customer.

The app updates weekly, and users can check their score as often as they wish without having to worry about the check adversely impacting their score.

The tool also offers a free score simulator, that helps people understand how changing their financial behavior might impact their scores in the future. Users may also be given offers for loans or credit cards that match their finances.

14) PrivacyGuard

PrivacyGuard is a premium identity theft protection tool that includes credit reporting, score tracking and credit education services.

There is an affordable introductory offer for the service, allowing people to check it out without spending a lot of money.

Users get access to their VantageScore and can request alerts for major changes such as negative marks on their account, significant balance changes, or new accounts being opened in their name.

There is also the option of daily credit monitoring that tracks all three of the major credit reference agencies.

15) Rocket HQ

Rocket HQ is a free tool that offers users access to their TransUnion credit report, and allows them to track their VantageScore.

The tool offers a number of financial education tools to help people understand how their credit and personal finances work, and also offers answers to common questions about things like mortgages and loans.

Rocket HQ is free to use, and checking your credit score with the service will not leave any significant marks on your credit report, so you can monitor your score as often as you wish.

16) LendingTree

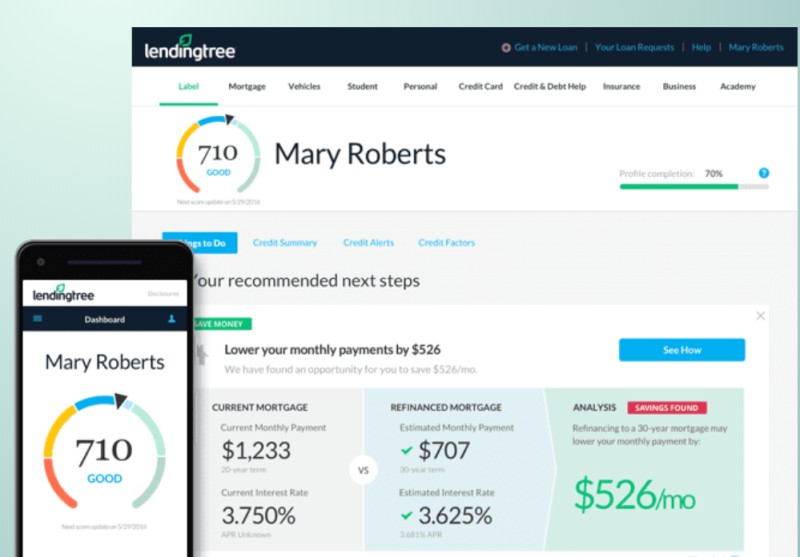

LendingTree offers a credit score service that provides users with an easy to understand report of their credit score in app or website form.

The service uses VantageScore 3, which is a score created from merging the credit scores reported by Equifax, TransUnion and Experian.

This score is not the score that most lenders use, but it is a very good estimate, and it is good enough to help users decide whether they are on the right track with their current financial habits. LendingTree’s easy to use app and simple signup process makes it appealing to many people.

17) NerdWallet Free Credit Score

Like many other tools, NerdWallet uses VantageScore 3.0 to allow users to keep track of their credit score.

This service is offered in app form for Android and iOS users, as well as via their website. Users can view their score, monitor their score for changes thanks to weekly updates, use the simulator tool to get an idea of whether changing their credit limits or paying down certain debts would be a good thing for their scores, and work to improve their credit scores with careful management thanks to the information offered.

18) myFICO

The myFICO app and website is run by FICO themselves, and has tiered pricing based on the features that the user wants.

The least expensive tier offers monthly updates on Experian credit files, while the other tiers offer 3-bureau monitoring at various intervals.

All tiers offer identity theft insurance. The FICO score is the score that 90% of lenders use, so it is the most useful score for people to have if they are considering taking out a significant loan in the near future.

The tool costs more than most other services, but for some people, especially those with families who are working towards a mortgage, the insurance offering could make it worthwhile.

Leave a Reply