Not everyone has a credit score. In fact, everyone starts without one! But how can you build a credit score if everything that lets you build a credit score also requires a credit score?

It’s simple. Apps like Grain make it possible to get a line of credit without a credit score, although there may be some caveats and limitations.

Today, we’re going to look at 22 apps like Grain. We have researched several apps that are alternatives to Grain to help you build your credit score.

What is Grain Digital Credit Card?

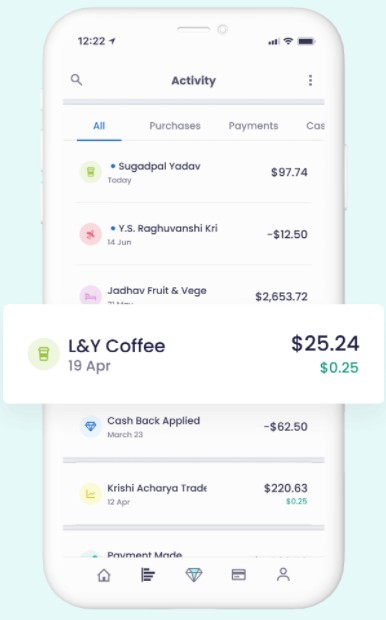

First: What is Grain Credit? Grain is a credit card alternative. You connect Grain to your bank account and Grain lets you use it as though it was a credit card.

Grain figures out how much of a revolving line you should have based on your income and your expenses.

There’s a 15% APR on charges — but it’s also designed to help you manage your expenses. It helps people build credit who might not otherwise qualify for credit.

Let’s now discuss the other alternatives we’ve found below:

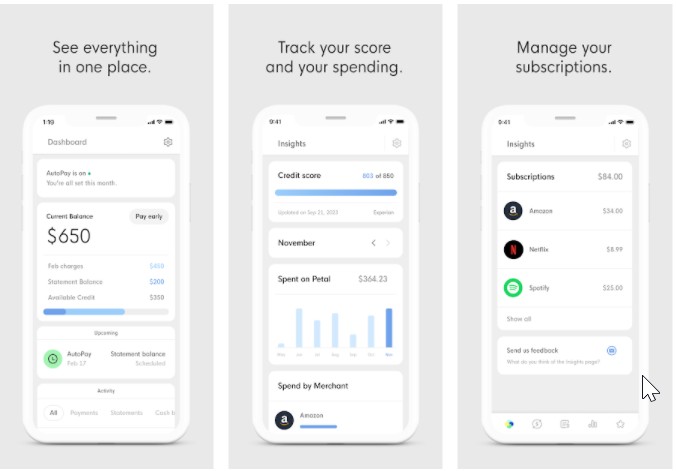

1. Petal Card

The Petal Card is a Visa card for those who don’t have any credit history. This credit card isn’t a secured card though; you don’t need to put any money down.

There are two versions of Petal. The first version has $300 to $5,000 limits and no annual fees, designed for those who have never established credit before.

The second version has $300 to $10,000 limits and no fees and is designed for those who are building their credit.

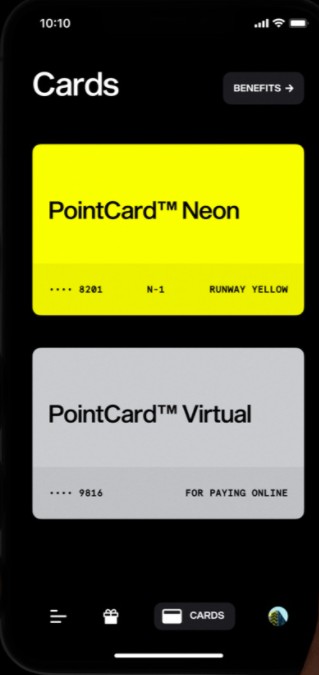

2. Point Card

The Point Card is basically a new evolution of a secured card. With the Point Card, users are able to load up a card and use it just like any other credit card.

But unlike many other secured cards, you do get points for your spending; so the card starts to pay you.

The Point Card is great for those who are just starting to build credit, but it doesn’t provide an unsecured credit line.

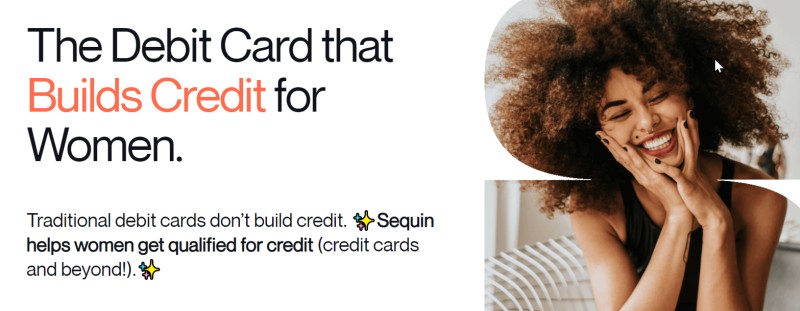

3. Sequin Card

A card designed for women, the Sequin Card is like a credit card that operates like a secured debit card.

It links to your bank account and is used just like a credit card rather than a debit card, so you have an additional layer of safety. It also builds credit while preventing debt.

4. Jasper Card

A card for those who want to manage debt, the Jasper Card offers up to a $15,000 credit line. It doesn’t just look at a person’s credit history but also at their bank account.

So, it’s a good idea for the self-employed and other people who may have a lot of cash at hand but not necessarily a lot of credit.

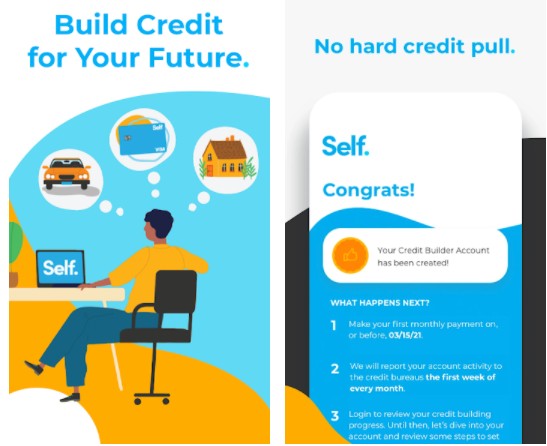

5. Self Card

Self Card is a straightforward card designed for those who either have no credit or need to rebuild their credit.

Through the Self Card, users are able to sign up for a credit card, automate payments, and see how their credit score is going up over time.

This is a good credit card for those who are still learning the basics of good credit and who want to be able to improve their credit with limited risk.

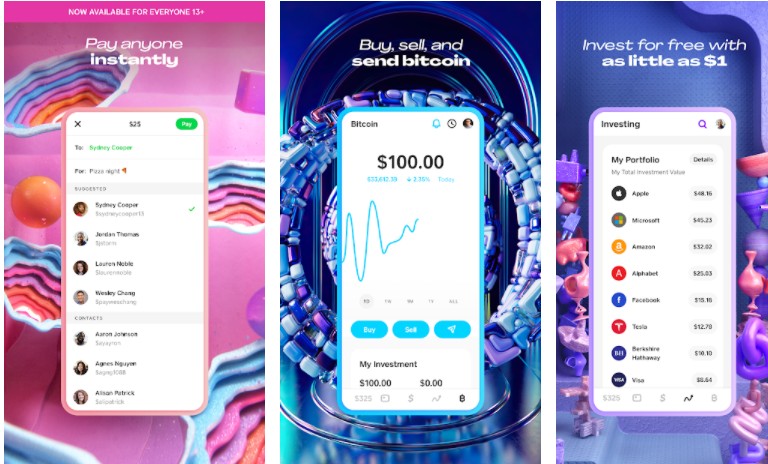

6. Cash App

Cash App is a bit unique in that it’s an app where you can store funds and then access them through a debit card.

But you can also use Cash App for investments such as cryptocurrency and stock investments. And you can use Cash App to send money back and forth such as with PayPal or Venmo.

For some, Cash App can be an all-in-one cash management app. But you should still keep an actual bank account on the side.

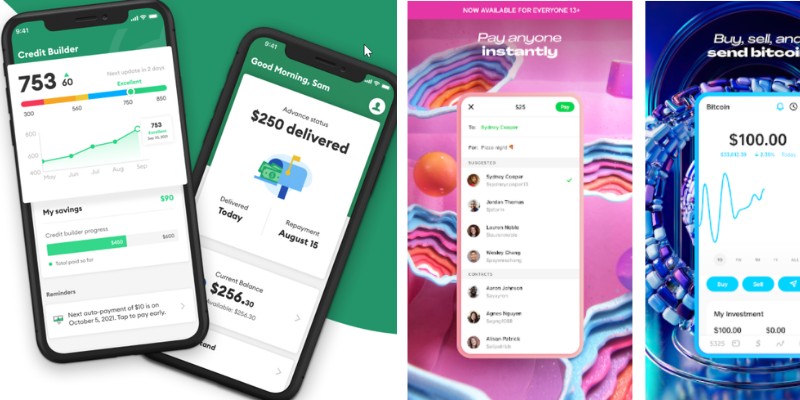

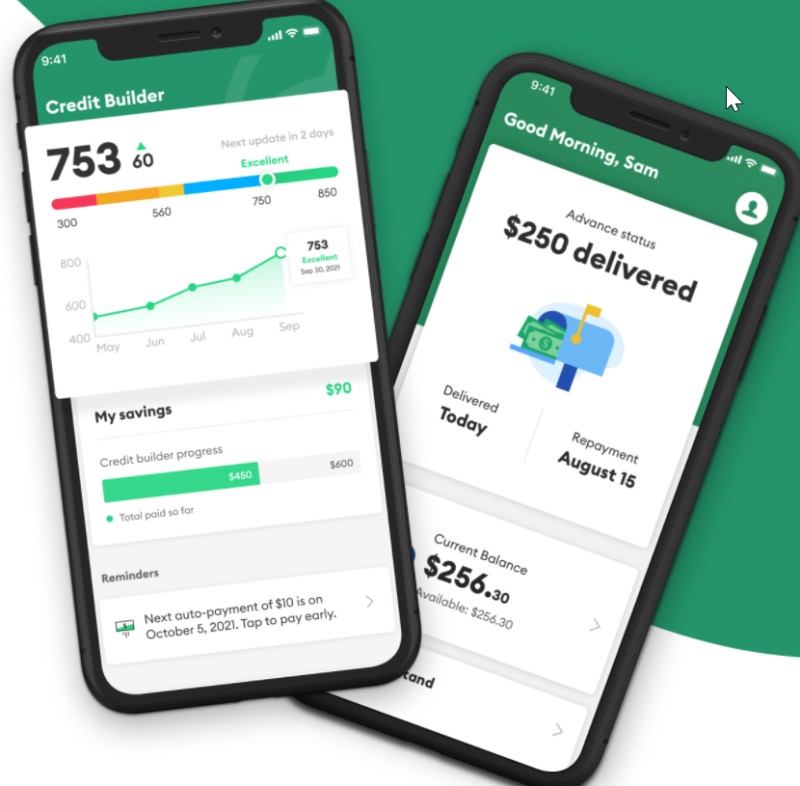

7. Brigit Card

The Brigit Card is a unique and interesting line of credit app. Brigit will give you a $250 advance without a credit check or interest.

From there, you can pay down that advance to build your score. According to Brigit, you can build it up by 60 points simply by paying it off.

But Brigit also provides real-time alerts, budgeting features, and savings trackings, to ensure that your budget remains on track.

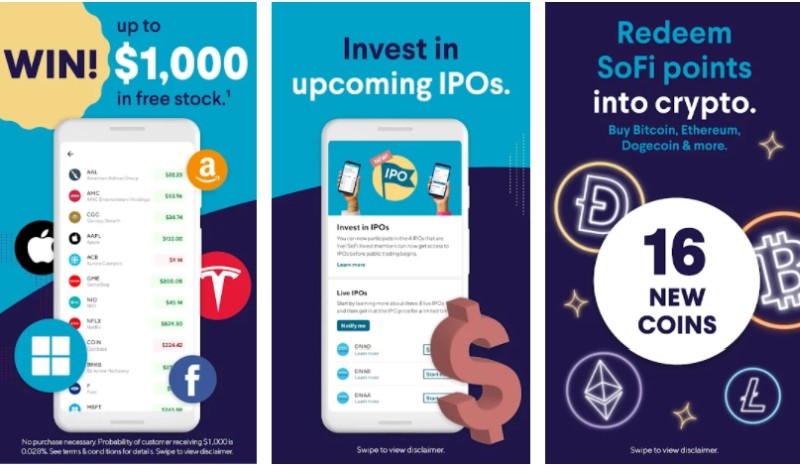

8. SoFi

SoFi is actually an alternative banking and investment portal which also offers debit cards, credit cards, and personal loans.

SoFi has even branched out into mortgages. SoFi is much like Cash App in that it can provide an all-in-one portal for anyone who wants to manage all their finances in a single place.

Be careful though, because SoFi isn’t a typical bank account, and consequently operates under different rules and regulations.

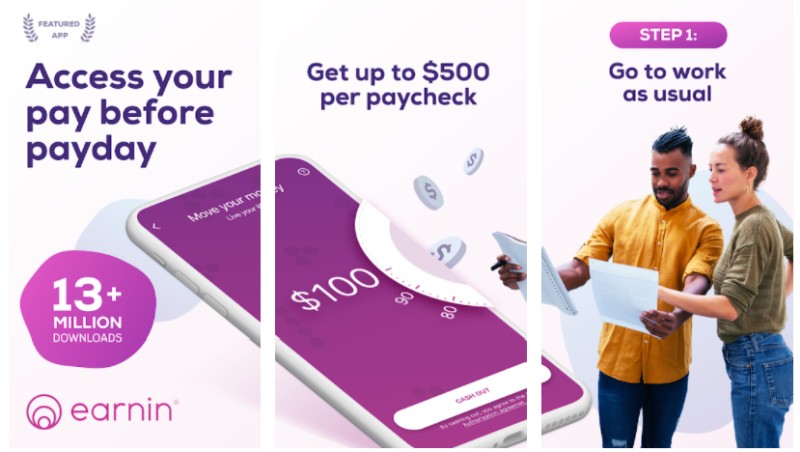

9. Earnin

A “cash before payday” app, Earnin makes it possible for you to get an advance on your paychecks by linking your bank account with the app.

Then, the app simply charges you for the advance when your paycheck comes in. Earnin takes the place of expensive payday loans, which used to be common before everything became digitized. There’s no APY (percentage interest) and there’s no fee, making this a great way to get an advance.

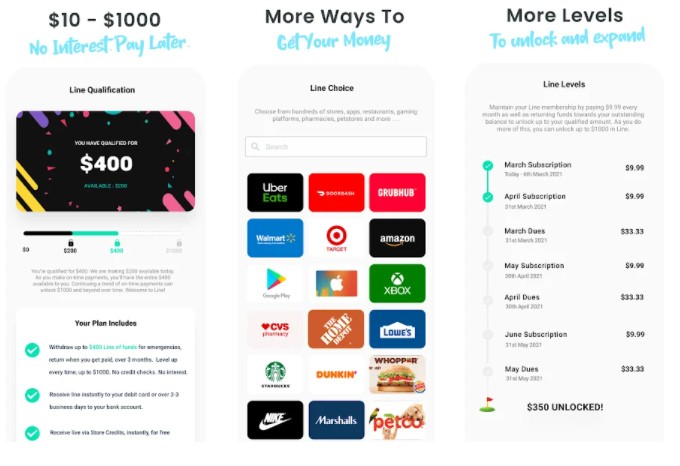

10. Line App

Through Line, people can get from $10 to $1,000 for emergencies without any interest. This makes it possible to take out a small “payday loan” if there is an emergency situation, such as a medical problem, or something that keeps you from working.

Pricing is about $2 for a line of credit up to $100 and $10 for a line of credit up to $500. And from the initial amount that you get, you can level up by using the credit responsibly.

11. Possible Finance

A financing company, Possible Finance offers up to $500 for people who have bad credit. In fact, they don’t even check your credit score.

You can receive funds quickly when you need it, so you can sort of get around not having a line of credit if you can’t qualify for one.

At the same time, this isn’t going to help your credit as much as actually establishing a credit line or an installment loan. Possible Finance is like an online payday loan, so you should be cautious about rates.

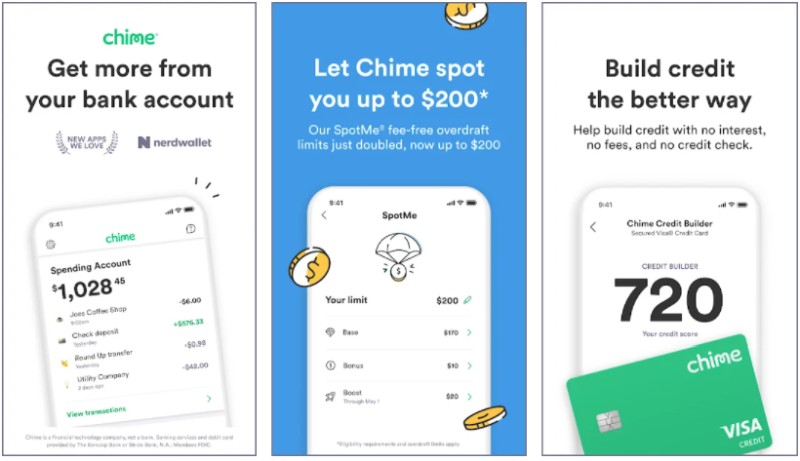

12. Chime

Another popular app, Chime is an alternative method of building credit. First, when your paycheck is deposited, it’s actually deposited early.

So you gain access to your funds two days before you otherwise would be able to, which can help you build up a cushion if you have debts that come close to your payment dates.

Second, it helps you increase your credit score by acting as a credit card rather than a debit card. And you can also use the app a lot like Cash App or Venmo, to send money to people directly.

13. Kikoff

Meant to help those who need to build a credit history from square one, Kikoff is a no-cost solution that offers users a maximum line of credit of $500.

The main benefit of the San Francisco-based company’s card is that it helps those who don’t want to plunk down any cash for a secured card and thus have no other way of beginning the credit-building journey.

There are no fees or interest, but there is a big catch: users can only “spend” the money on the company’s site-based store.

Kikoff reports to two of the major credit bureaus, and there are no credit checks. The card only comes with $500 on it, no more and no less.

14. One Finance

One Finance offers the One card, much like a savings-based bank account. Members can create “pockets” to designate for different savings goals. Interest is generally one percent on deposits but is three percent on auto-save pockets.

Not a line of credit card, One is more of an online non-bank but with FDIC insured accounts.

One is a good option for people who want to use fee-free ATMs and deal with an online-only financial institution, often called neo-banks.

15. NetCredit

For people with bad credit who have nowhere to turn, NetCredit offers direct-to-consumer installment loans.

The interest rates are high, but there’s no hard credit check or waiting for the funds. Most loans are completed in one business day.

There are origination fees that can cut into the loan balance, and amounts lent range from $1,000 to $10,000.

Applicants must have verifiable income, be 18 or older, have a valid US social security number, and own a checking account and email address. Interest rates tend to be at or over 100 percent.

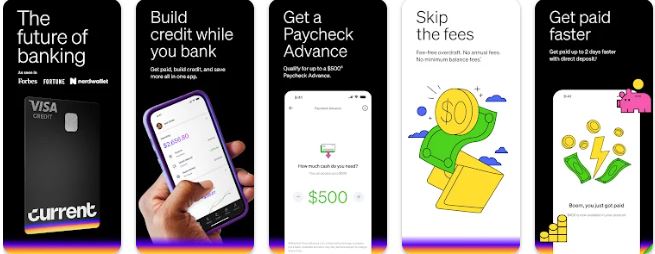

16. Current

Cash deposits on this neo-bank debit card come with a fee, and there is no customer service via phone.

However, up to $6,000 of deposits in the “savings pod” earn four percent interest, and there are lots of different cash-back rewards.

The Current card is designed to work with multiple mobile apps, and withdrawals at 40,000-plus ATMs incur no fee.

There are no monthly fees and no minimum deposit required. Users can redeem points for goods or cash.

It’s always free to make mobile check deposits after downloading the app, but depositing cash via participating retailers costs $3.50 per transaction.

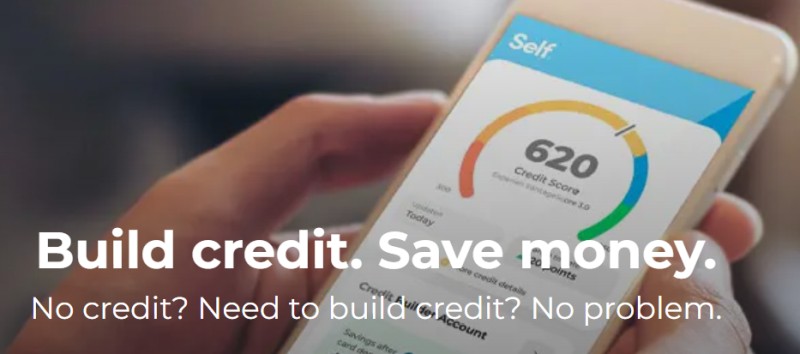

17. Self

Self is unique in that it offers all users the chance to take out “credit-builder” loans that were once only available to holders of special credit unions and a few community-based banks.

There’s no need for upfront deposits. Instead, Self “loans” users the money after the account holder makes on-time payments to fund the loan.

In essence, the whole point is to help people build credit when they have no other way to do so. After the loan is funded, Self releases a check to the borrower for the full amount plus interest.

Payments can be as low as $25 monthly, and Self reports to all three credit bureaus.

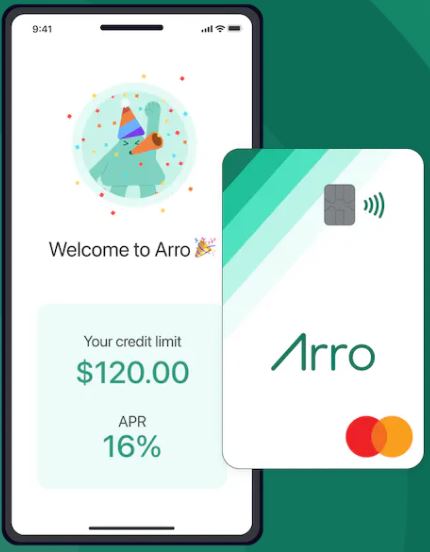

18. Arro Card

For convenient financial transactions, the Arro prepaid Mastercard is excellent for people with restricted or limited access to everyday banking services.

Users manage all their activity via the mobile app and never need to worry about a credit check or the need to have a traditional bank account.

The features of the Arro card include the ability of users to load funds onto it any time they need to. Then, they can use it wherever Mastercard is accepted, whether in stores or with online merchants.

The mobile app makes it simple to track transactions, load money, and manage the account, all of which is possible via a smartphone.

Security features are above-average. Users can lock or unlock their Arro card anytime they need to via the app. They can even set up direct deposit of paychecks or similar funding sources to go straight to the Arro card account.

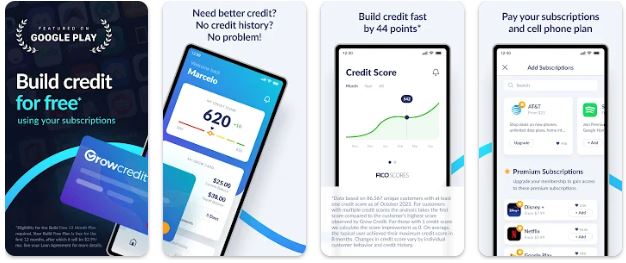

19. Grow Credit

The Grow Credit financial app leverages a clever method for helping users rebuild or build credit by reporting subscription payments to the major credit bureaus.

People can even link their utility bills, Spotify, Netflix, or similar accounts to their Grow Credit account to boost credit scores without borrowing money.

The card reports recurring subscriptions directly to the bureaus, and there are no fees or interest for the service. There are tools on the app to monitor your credit scores and track progress.

The innovative solution is perfect for folks who need to establish or rebuild credit but who don’t want to borrow to do so.

20. BrightWay Credit Card

For users who prefer flexible redemption options and multiple perks, the BrightWay Credit Card is a rewards card that does that and more.

The goal of the company is to improve the spending experience of holders. There are rewards for most purchases, like points, miles, and cash-back. It’s simple to redeem rewards for things like travel, merchandise, statement credits, and gift cards.

There are signup bonuses or 0% APR promotions occasionally. Security is high, with fraud protection, no liability for unauthorized charges, and high-tech chip technology.

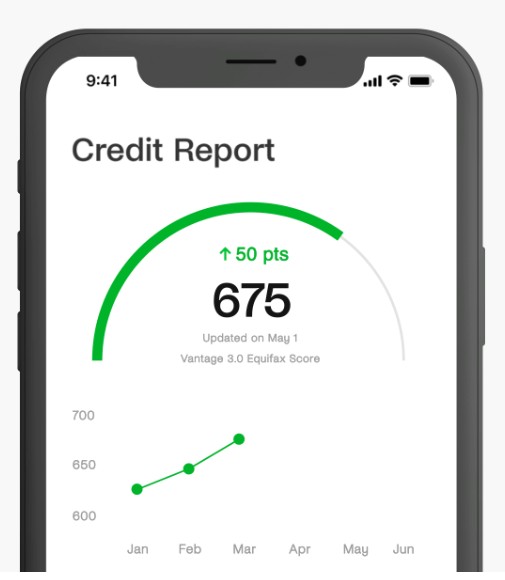

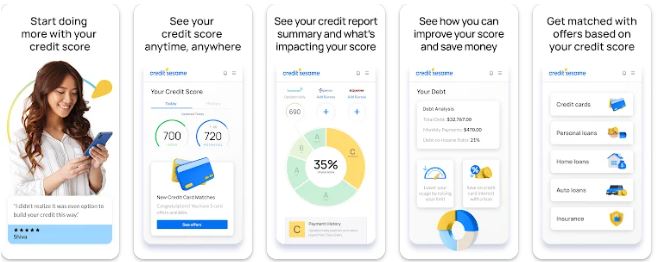

21. Credit Sesame

Credit Sesame’s goal is to assist cardholders with general financial health and managing credit scores. Features include no-cost credit report analysis, free credit score monitoring, and personalized recommendations for boosting credit scores.

Tools include debt trackers, loan management, and identity monitoring to minimize the risk of fraud. There are credit monitoring alerts that pop up whenever your score changes.

Credit Sesame offers users an easy way to learn about their financial health, monitor it, and take action to improve it.

22. Current

The Current mobile banking app offers a sophisticated banking experience that is suited to individual needs.

Features include no-fee checking, early access to direct deposits, instant ability to transfer and send money.

There are rewards when you use your Current app for common purchases, like groceries, dry cleaning, and fuel.

The app also has some powerful budgeting tools, so people can establish savings goals, track spending, and manage their everyday finances.

There are other features, like bill pay, a vast ATM network, mobile check deposit, and more. Current offers convenience and a simple banking experience in an easy-to-use mobile app that works on any device.

Getting a Line of Credit Without a Credit Score

The above list really includes two types of app. One is a line of credit that you can get without a credit score (whether it’s secured or not).

The other is a payday loan type of app, which lets you borrow money against your future earnings. Either of them can help you start to build credit and can give you access to credit if you have an emergency.

What you need to pay attention to is the interest rate, the loan origination fee, and the annual fees. Always look at how much money your money is costing you and choose the least expensive option.

All these apps are designed to help you build credit and use it responsibly. But they still require that you do use them responsibly. Never borrow anything that you don’t need to borrow, even if you can pay it back — and never borrow anything that you can’t pay back.

I stumbled across your link when on the Grain app. Think I’m gonna pass on that, they’re squirrelly. Any who thanks for doing the homework on the cards, etc. Absolutely helpful and definitely going to look into a few.

Thanks for all the info. Definitely saving your post for future reference.